south dakota property tax laws

43-31-3 Homestead containing one or more lots or tracts of land--Contiguous tracts--Use in good faith. Find a variety of tools and services to help you file pay and navigate South Dakota tax laws and regulations.

Property Tax South Dakota Department Of Revenue

2021 South Dakota Codified Laws Title 10 - Taxation Chapter 06B - Property Tax Reduction From Municipal Taxes For The Elderly And Disabled.

. The authority to levy property taxes The County Director of Equalization DOE assesses the value of all. The property tax is the primary source of revenue for local governments. The basic provisions of South Dakotas tenant rights laws including anti-discrimination laws deadlines for the return of security deposits and more.

Title 10 Codified Laws on Taxation. Most of South Dakotas property tax laws are codified in various chapters of Title 10 of the South Dakota Codified Laws. Taxpayer Bill of Rights.

2022 - SD Legislative Research Council LRC Homepage SD Homepage. Tax Breaks and Reductions. SDCL 10-5 Situs of Property for Taxation.

Aside from inheritance and estate taxes South Dakota is generally a tax friendly state. Sales tax is low in South Dakota. What is the Property Tax.

For example d some states may tax trust distributions originating from a South Dakota residents trust if the distributions. Like hotel and BB stays short-term rentals in South Dakota are subject to tax. Section 10-6B-8 - Eligibility of head of household for reduction.

You Dont Have To Solve This on Your Own Get a Lawyers Help. General Property Tax Rules. The head of the household must be sixty-five years of age or older or shall be disabled prior to January first of the year in.

The statewide rate is 450 and most. Office of the State Treasurer Unclaimed Property Division 124 East Dakota Ave Pierre SD 57501-5070 Phone. Ad valorem refers to a tax imposed on the value of something as opposed to quantity or some other measure.

Meeting with a lawyer can help you understand your options and how to best protect your rights. Section 10-6B-1 - Definition of terms. Legislative Research Council 500 East Capitol Avenue Pierre SD 57501.

6057733379 or 8663572547 Fax. 6057733600 For TTY services call 711 Fax. Most of South Dakotas property tax laws are codified in various chapters of Title 10 of the South Dakota Codified Laws.

The State of South Dakota does not levy or collect any real property taxes. Dlrrealestatestatesdus DLR Home State Home Equal Opportunity Accessibility Policy Contact Us. SDCL 10-6 Annual Assessment of Property.

Failure to comply with state and local tax laws can result in fines and interest penalties. Section 10-6B-7 - Amount of reduction of real property taxes due for a multiple-member household. If someone from another state leaves you an inheritance check local laws.

Businesses who would like to apply for reinstatement with the Secretary of States office must first receive a tax clearance certificate from the Department of Revenue. So even money you earn from a post-retirement job wont be taxed by the state. South Dakota Nonprofit Corporation Act SD.

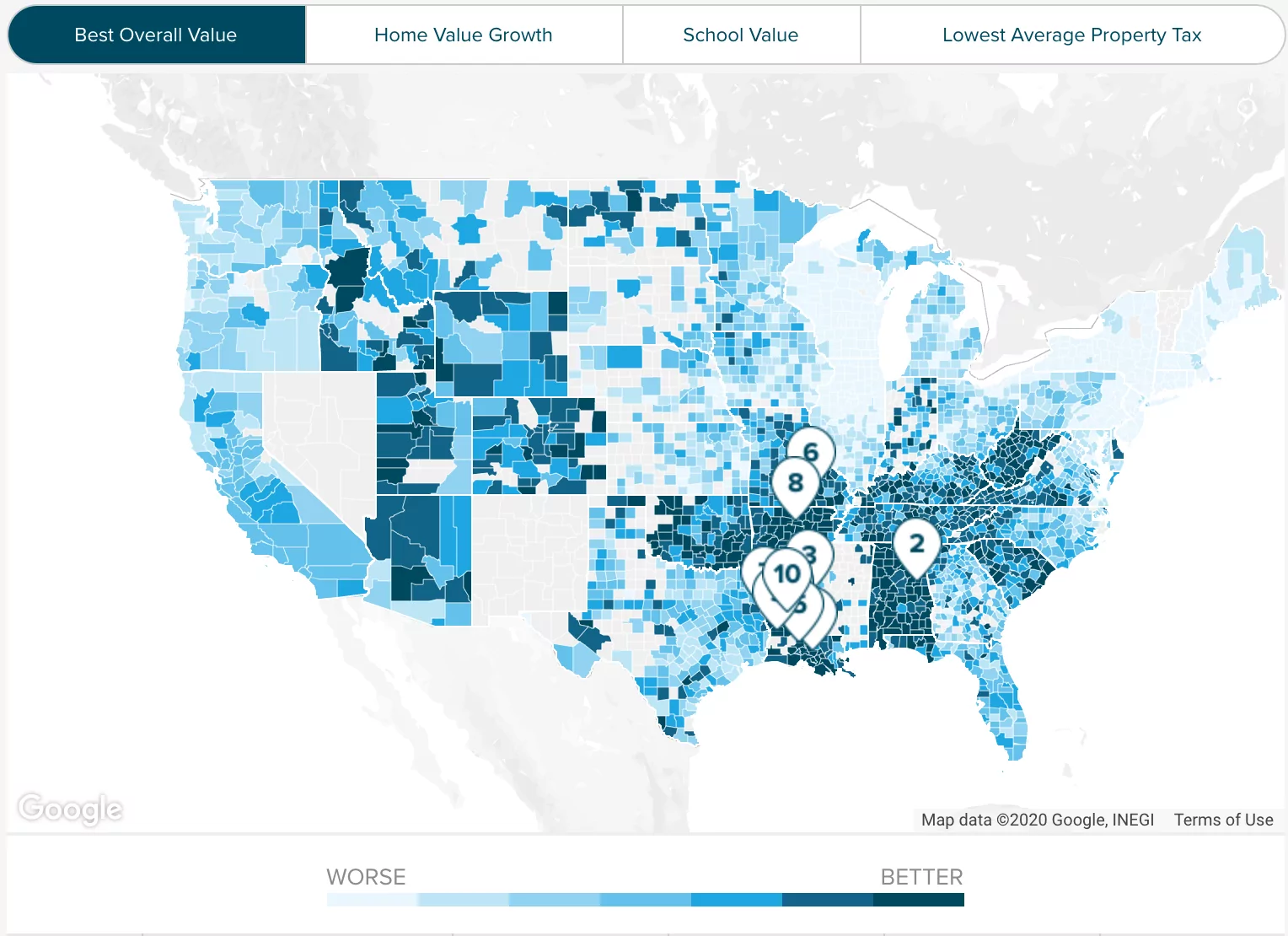

South Dakota also does not levy the gift tax but the federal gift tax applies on gifts totaling more than 15000 in one calendar year. South Dakota Codified Laws 43-31. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year.

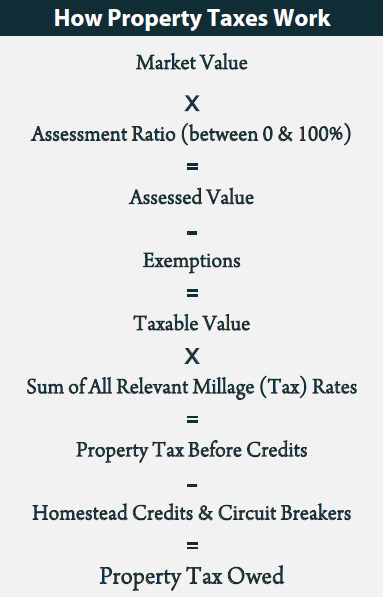

If the county is at 100 fair market value the. Sales and property tax refunds and property tax freezes are available to seniors who meet the qualifications. Article 2069 - Real Estate Brokers and Salespersons 217 W.

Tax authorities require short-term vacation rental hosts to collect applicable short-term rental taxes from their guests and remit them to the proper authorities. However other states may tax people or property within South Dakota baseon those states laws. Laws 47-22-1 et seq.

South Dakota is ranked number twenty seven out of the. - Pierre SD 57501 Phone. South Dakota Tenant Rights Laws.

If a condominium or homeowners association is organized as a nonprofit corporation it will be governed by the Act. The property tax system in South Dakota consists of two parts. Rules Concerning the Certification of Assessing Officers.

43-31-1 Homestead exempt from judicial sale judgment lien and mesne or final process--Mobile homes--Senior citizens. Inheritance taxes are imposed upon the deceaseds heirs after they have received their inheritance. I-130 Petition for Alien Relative.

There is no authority in state law that allows for a deferment or a delay of the property tax payment deadlines. To qualify the following conditions must be met. Property Tax Codified Laws.

Under South Dakota law SDCL 10-6-131 landowners may submit a Request for Ag Land Adjustment to the Director of Equalization in the county the land is located in. The law governs the corporate structure and procedure of nonprofit corporations in South Dakota. 128 of home value.

Visit the South Dakota Secretary of State to find an. SDCL10-4 Property Subject to Taxation. Administrative Rules of South Dakota ARSD Regulated by the Commission.

The property tax is an ad valorem tax on all property that has been deemed taxable by the South Dakota Legislature. SDCL 10-18A-1 to 10-18A-7 states that certain low income property owners are eligible for a property tax refund and should check with their county treasurer for details and assistance in making application. South Dakotas average effective property tax.

SDCL 10-1 Department of Revenue. View and Download FREE Form PT-38C Application for Property Tax Homestead Exemption related FREE Legal Forms instructions videos and FREE Legal Forms information. Rather property taxes are imposed by your local cities schools counties and townships and are collected by your local county treasurer.

43-31-2 Homestead limited to house or mobile home and appurtenant buildings--Business place--Minimum size of mobile home. State law provides several means to reduce the tax burden of senior citizens. The Property Tax Division is responsible for overseeing South Dakotas property tax system including property tax assessments property tax levies and all property tax laws.

South Dakota laws require the property to be equalized to 85 for property tax purposes. Tax amount varies by county. The last thing you want to deal with is missing a tax payment.

South Dakota does not levy several taxes that other states impose such as a state income tax. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

Property Tax Comparison By State For Cross State Businesses

Colorado Property Tax Calculator Smartasset

Texas Taxable Services Security Services Company Medical Transcriptionist Internet Advertising

Property Tax South Dakota Department Of Revenue

Property Tax South Dakota Department Of Revenue

Understanding Your Property Tax Statement Cass County Nd

Property Tax South Dakota Department Of Revenue

Little Known Tax Advantage Benefits Minnesota Businesses Finance Commerce

How Is Tax Liability Calculated Common Tax Questions Answered

How Taxes On Property Owned In Another State Work For 2022

Understanding Your Property Tax Statement Cass County Nd

The Effect Of Tax Laws On Commercial Real Estate Cyber Security Education Legit Work From Home School

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

A Breakdown Of 2022 Property Tax By State

Property Taxes By State County Lowest Property Taxes In The Us Mapped

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)