pa tax payment forgiveness

At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they.

Pennsylvania Exempts Canceled Student Loans From Taxes Whyy

What is Pennsylvania special tax forgiveness credit.

. To claim this credit it is necessary that a taxpayer file a PA-40. Record tax paid to other states or countries. Provides a reduction in tax liability and.

Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they havent paid their Pennsylvania income tax. For taxpayers who earn a wage the employee can. The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability.

Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they havent paid their Pennsylvania income tax. Provides a reduction in tax liability and. The Tax Forgiveness Program allows low income taxpayers to either reduce or eliminate their tax liability through tax forgiveness credits.

In Part D calculate the amount of your Tax Forgiveness. We Help Taxpayers Get Relief From IRS Back Taxes. ELIGIBILITY INCOME TABLE 1.

Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Then move across the row to find your eligibility income.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. What is Pennsylvania special tax forgiveness credit. Pennsylvania Department of Revenue Online Services Make a Payment.

Eligibility income is greater because it includes many nontaxable forms of income such as interest on savings. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Eligibility income for Tax Forgiveness is different from taxable income.

However any alimony received will be used to calculate your PA Tax Forgiveness credit. To receive tax forgiveness a. Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. The Tax Forgiveness program allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Record the your PA tax liability from Line 12 of your PA-40.

Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania. For example a family of four couple with two dependent. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Property TaxRent Rebate Status. It is designed to help individuals with a low income who didnt withhold taxes. Wolf notes that for a public service worker with 50000 in forgiven student loans in Pennsylvania will now be able to avoid a 1535 state income tax bill.

Provides a reduction in tax.

State Conformity To Cares Act American Rescue Plan Tax Foundation

Pennsylvania Will Not Tax Student Debt Forgiveness Witf

Don T Pay Sales Tax For Home Improvements Ny Nj Pa

Pennsylvania Tax Notice Of Assessment Rev 364c Sample 1

Form Pa 40 Sp Fillable Pa Schedule Sp Special Tax Forgiveness

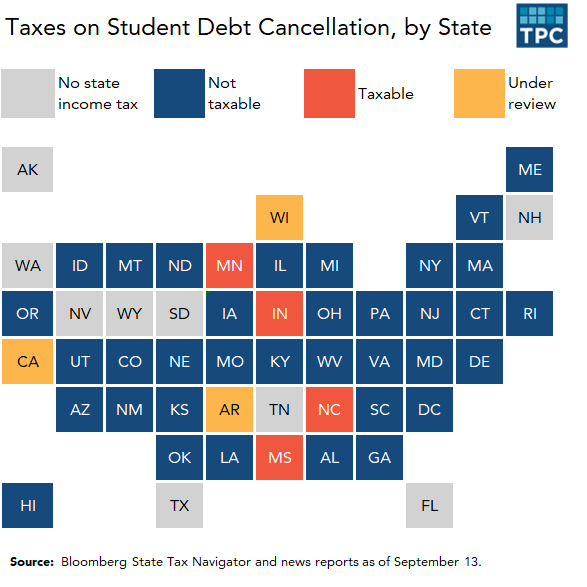

Which States Tax Student Loan Forgiveness And Why Is It So Complicated Tax Policy Center

Pennsylvania Residents Could Pay Taxes On Their Student Loan Relief

Senator Lindsey M Williams Announces Student Loan Forgiveness Programs No Longer Subject To State Income Tax Pennsylvania Senate Democrats

Form Pa 40 Sp Fillable 2014 Pa Schedule Sp Special Tax Forgiveness

Pennsylvania Department Of Revenue With The Personal Income Tax Filing Deadline Approaching On May 17 2021 The Department Of Revenue Is Reminding Low Income Pennsylvanians That They May Be Eligible For A

Pa Gov Tom Wolf Removes State Income Tax On Student Loan Debt R Erie News Now Wicu And Wsee In Erie Pa

Pennsylvania Pa Tax Forms H R Block

Pennsylvania State Tax Updates Withum

Pa Dept Of Revenue Encourages You To Use Electronic Filing Options To File State Income Taxes Fox43 Com

Make A Pa Earned Income Tax Credit Part Of The Budget

Pa To End State Tax On Student Loan Forgiveness Pahomepage Com

Offer In Compromise Settle Irs Debt Free Consultation

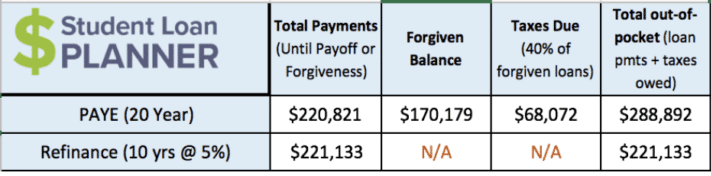

Physician Assistant Loan Repayment Options How To Pay Pa School Debt